Learning

Center

|

|

Model

Portfolio

|

|

|

|

3rd Quarter,

2002

September 30, 2002

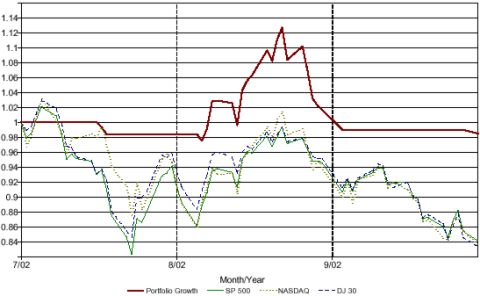

During most of July the market

averages continued their downward path reaching new lows and then rallying

furiously for almost a month. That rally pumped our portfolio more than

12% but our new stop system, which was designed to keep us longer in the

markets, managed to give back all the profits. What happened was that the

turnaround was so quick that, our new trailing stops were hit before the

trend indicators signaled the end of the move. However, after a brief

study, it was determined that even if we had kept the old stop system in

place, the end result would had been more or less the same. The old system

would have taken us out quickly, thereby keeping more profits. However, the trend indicator, still signaling

an uptrend, would have taken us in again, just in time to get caught in the

new downtrend. It was not until mid September that our trend indicator

changed direction from up to down. As a side note, it is interesting to

note that most of the profit loss actually came from our Russell 2000

position, whose entry signal was given 7 trading days after the rest of

the indexes we trade. As a matter of fact, Our position in the Dow Jones

broke even and the S&P500, S&P400 and Nasdaq-100 were close at

profits of 2.12% (0.39R), 2.51% (0.52R) and 1.40% (0.20R) respectively.

The loss on the Russell 2000 was 3.23% (0.51R). Still we managed to hold ground overall, greatly

outperforming the S&P500. Considering that the failed rally didn't

raise the indexes high enough, we decided NOT to open short positions.

This date also marks the first

anniversary of the portfolio. While our reliability of 63.33% is close to

that of our historical study, our expectancy of -0.03 is way out of

target. A review of the trades made through the period showed us that the

main problem resides in low R multiples for the winning trades. To this

date all losing trades, except one, have -1R or less. The only exception

was a -1.47R trade, made during the 4th quarter of 2001 and that was the

direct result of a discipline failure. One more reason to implement the

new stop management system. The adjustments made to our stop system will help us

to boost the size of our gains relative to our initial risk. Also, we

recognize that the decision to use stop orders had a direct impact on the

expectancy by adding to our transaction costs on an account with low

equity. However we are willing to delay the target date for achieving our

estimated expectancy, because the implementation of stop orders had

greatly improved the trading discipline. The

table below shows the performance of our portfolio net of management fees

and before taxes,

compared to the major U.S. indexes that we traded.

|

From Sep. 30, 2001 to Sep. 30, 2002 |

| GCM Model Portfolio |

-3.41% |

| Dow Jones 30 |

-14.19% |

| S&P 500 |

-21.68% |

| Nasdaq-100 |

-28.75% |

| S&P 400* |

-6.19% |

| Russell 2000 |

-10.52% |

| * For this index figure we used the ETF

MDY as a proxy |

Considering that we used our system almost entirely on the long side (28

out of 30 trades), the result of

the first 12 months are within reason.

Portfolio

Statistics

|

Final

Allocation

|

|

|

Performance

Period

to Date

|

Performance |

GCM

Portfolio |

S&P

500 |

|

| Quarter (1) |

-1.07% |

-15.83% |

| Quarter (2) |

-1.57% |

-15.83% |

| Year (1) |

-7.15% |

-28.99% |

| Year (2) |

-8.63% |

-28.99% |

|

(1)

Before management fees

(2)

Net after fees |

|

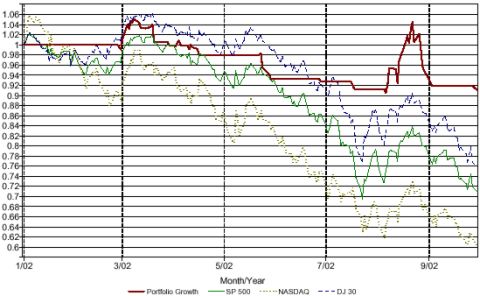

| Charts and data processed with

Captools Software and proprietary spreadsheets. Performance

net after management fees. Certain fixed expenses and taxes

excluded. |

|

|

Performance

Charts

|

|

|

Quarter to Date

|

|

|

Year to Date

|

|

|